child tax credit october 2021 schedule

Up to 300 dollars or 250 dollars depending on age of child. Enter your information on Schedule 8812 Form.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

September 24th 2021 0858 EDT.

. Three payments of the credit have already been sent out and three more are to come in 2021 with the next one due on October 15. The next advance monthly payment will be disbursed on. Still time for eligible families to sign up for advance payments.

The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. Oliver Povey Olabolob Update. Get your advance payments total and number of qualifying children in your online account.

112500 for a family with a single parent also called Head of Household. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. 2 days agoPrior to the expansion and boost to the Child Tax Credit in the spring of 2021 under the American Rescue Plan the last revision of the tax code in 2017 the Tax Cut and Jobs Act TCJA doubled.

The IRS will send out the next round of child tax credit payments on October 15. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Part of the American Rescue Plan eligible parents can get half of their allowance before the end of 2021 and the.

The other half will be paid out on your 2021 tax return when you file in 2022. October 5 2022 Havent received your payment. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The Child Tax Credit has been expanded from 2000 per child annually up to as much as 3600 per child. To reconcile advance payments on your 2021 return.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The complete 2021 child tax credit payments schedule. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit.

The advance is 50 of your child tax credit with the rest claimed on next years return. Families will receive 3600 for each child under the age of 6 while receiving 3000 for. IR-2021-153 July 15 2021.

Families now receiving October Child Tax Credit payments. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. October 29 2021.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Your monthly child tax credit payment is also dependent on your income and the ages of your. 150000 for a person who is married and filing a joint return.

3600 for children ages 5 and under at the end of 2021. The IRS is relying on bank account information provided by people through their tax. Subsequent opt-out deadlines for future payments will occur three days before the first Thursday of the month from which a person is opting out.

Up to 300 dollars or 250 dollars depending on. Typically you can expect to receive up to 300 per child under age of 6 250 per child ages 6 to 17. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the.

3000 for children ages 6 through 17 at the end of 2021. This first batch of advance monthly payments worth roughly 15 billion. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment dates.

IR-2021-201 October 15 2021. By August 2 for the August. March 10 2022.

Wait 10 working days from the payment date to contact us. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. The 500 nonrefundable Credit for Other Dependents amount has not changed.

Parents of a child who. The deadline for the next payment was October 4. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

10 Ecommerce Marketing Strategies For Black Friday Cyber Monday Filtergrade Christmas Card Template Personal Celebration Christmas Card Templates Free

Updated February 2020 You Can Claim The Federal Adoption Tax Credit If You Adopted A Child Other Than A Stepchild Y Tax Credits Foster Care Adoption Adoption

Publication 505 2021 Tax Withholding And Estimated Tax Internal Revenue Service Worksheets Consumer Math Adjective Worksheet

Pin On Foster Adoptive Info Blogs

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

Cute Monthly Budget Printable Free Editable Template Budget Planner Template Household Budget Template Monthly Budget Template

Don T Panic If You Missed The 5 October Self Assessment Registration Deadline All Is Not Lost Low Incomes Tax Reform Group

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

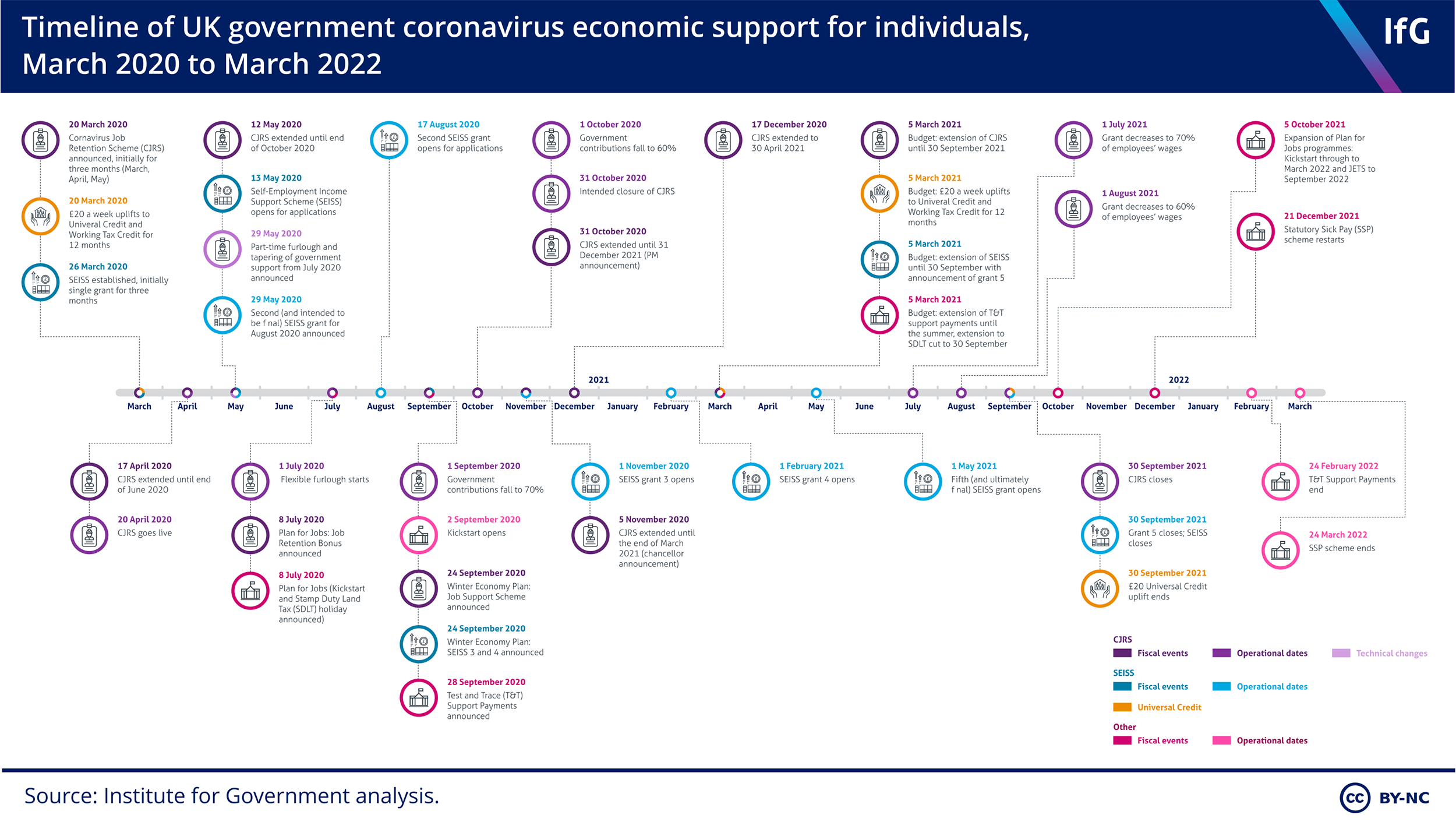

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Coronavirus What Economic Support Did The Government Provide For Individuals And Businesses The Institute For Government

Child Tax Credit Schedule How Many More Payments Are To Come Marca

Universal Credit Statistics 29 April 2013 To 14 October 2021 Gov Uk

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Your In 2021 Accounting Services Small Business Accounting Irs Taxes

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group